bootsshops.ru Categories

Categories

Amazon Sponsored Brand Video Ads

Amazon Sponsored Brands Video Ads offer brands a powerful tool to increase visibility, engage with potential customers, and drive sales. Video ads feature a single product with an auto-play video and can be found on both the search results for relevant keywords and product detail pages. Videos. video Ad format. Sponsored Brands video ads. Help new shoppers in your category on the Amazon store discover your brand and products with customized video ads. Sponsored brands is about visual creatives and your brand storefront. If you have good videos and custom lifestyle images it can be a great way. If you are a seller, advertising on Amazon Video may do wonders for your brand, traffic, clicks, and ultimately, sales. This is a powerful way to reach. Your video should be horizontal, have a aspect ratio, and a resolution of p. Keep your video short and punchy. Have the main message of your ad appear. This ad format features a horizontal or vertical video that tells your brand story or showcases an individual product or a collection of products. increase visibility and drive brand awareness on Amazon with our amazon sponsored brand video pack. target shoppers and provide more opportunities. Amazon has released a new beta, Sponsored Brand Videos, which allows you to share video content right in the search results to help your customers convert. Amazon Sponsored Brands Video Ads offer brands a powerful tool to increase visibility, engage with potential customers, and drive sales. Video ads feature a single product with an auto-play video and can be found on both the search results for relevant keywords and product detail pages. Videos. video Ad format. Sponsored Brands video ads. Help new shoppers in your category on the Amazon store discover your brand and products with customized video ads. Sponsored brands is about visual creatives and your brand storefront. If you have good videos and custom lifestyle images it can be a great way. If you are a seller, advertising on Amazon Video may do wonders for your brand, traffic, clicks, and ultimately, sales. This is a powerful way to reach. Your video should be horizontal, have a aspect ratio, and a resolution of p. Keep your video short and punchy. Have the main message of your ad appear. This ad format features a horizontal or vertical video that tells your brand story or showcases an individual product or a collection of products. increase visibility and drive brand awareness on Amazon with our amazon sponsored brand video pack. target shoppers and provide more opportunities. Amazon has released a new beta, Sponsored Brand Videos, which allows you to share video content right in the search results to help your customers convert.

As far as how a Sponsored Video Ad is set up, you still have the same parts of a listing, including the item and price, but added to that is the video. First. Sponsored Brands must be x90, x90, x, x, x or x Please refer to Section for Sponsored Brands video guidelines. 3. Content. Sponsored Products or sponsored ads are keyword-targeted ads that appear in search results and product detail pages on Amazon. They feature a product image. Amazon recommends that the duration of video ads should be controlled between 15 and 30 seconds, and it is necessary to ensure that the video content is. Sponsored ads on Amazon help build your brand and drive sales. Invest in long-term business growth by advertising your brand and products on Amazon. One of our clients saw a 10% increase in ad sales after launching Sponsored Brand Video. This client relies heavily on branded conversions but has strict ACoS. Avoid these to ensure Amazon approves your Sponsored Brands video ad. Today, it's also available on the android Amazon app and in desktop environments. With sponsored brand video, Amazon is paving the way for the eCommerce market. Sponsored Brands—a customizable, cost-per-click ad solution—can help extend your advertising efforts. You're on Amazon to help more people discover your brand. Amazon recommends that the duration of video ads should be controlled between 15 and 30 seconds, and it is necessary to ensure that the video content is. For a strong Sponsored Brand Video, follow an Introduce, Inspire and Educate, Call-to-Action format. First, introduce your product. Second, use visuals and text. 1. Product Description: A brand's product image ad, title, rating, number of reviews, price of the product, and prime eligibility are displayed. · 2. Sponsored. Sponsored Ads for Amazon are those ads that are placed on the top of Amazon's search results page because the advertiser paid for them to be placed there. When. Create Amazon Video Ads That Convert. With Trellis Video Creatives you can craft compelling Amazon Sponsored Brands video ads that convert in minutes. Harness. Sponsored Brands Video is the newest feature of Amazon Advertising. It does not require any special applications or account approvals other than brand registry. Amazon Sponsored Brand Video Ads are a great way to promote your products and increase sales. The video ads appear on search result pages, which means customers. Amazon Sponsored Brands Video Ads are video advertisements unique to members of the Amazon Brand Registry. These video advertisements appear in the same place. What Are Amazon Sponsored Brand Videos? Customers who land on the Amazon website are there to shop; their intent to buy is very high, and it's easy to. Amazon video ads allow advertisers to reach Amazon customers with targeted video on Amazon's websites, mobile apps, and Fire tablet wake screen. Amazon Sponsored Brands Video Ads are a relatively new service created by Amazon in These advertisements typically appear halfway down the first page of.

Email To Confirm Receipt

Confirm Payment Receipts in your email · As a result, the term means to prompt the receiver to respond. · Generally, formal messages or emails use “please confirm. How to Re-send a Receipt / Confirmation Email. As a fundraiser host or Admin user, you have the ability to re-send receipts. This is useful in cases where a. Yes, both are OK. I use "receipt" more both because it is marginally faster to type and because it's somewhat more formal. Also, "please confirm. Receipts and confirmation emails can be sent from your Dashboard to any email address. Sending a reservation receipt To send a. After you've had your conversation and nailed down the details, send that email as a summary or action plan — it's your receipt for what was discussed and. The Confirm Receipts workflow sends notifications through the Web or email to requesters or buyers who create requisitions in Oracle Fusion Cloud Self. A confirm receipt lets you know your message hit the inbox or was opened by the recipient. Think of it like getting a nod across the room—it doesn't start a. Understanding letter writing makes professional emailing very easy. Here are a few tips on how to write acknowledgment email replies. Confirmation of Payment for Invoice no. {{bootsshops.ru}}. BODY. Dear {{bootsshops.ru}}, We are pleased to confirm that we have received your payment for Invoice no. Confirm Payment Receipts in your email · As a result, the term means to prompt the receiver to respond. · Generally, formal messages or emails use “please confirm. How to Re-send a Receipt / Confirmation Email. As a fundraiser host or Admin user, you have the ability to re-send receipts. This is useful in cases where a. Yes, both are OK. I use "receipt" more both because it is marginally faster to type and because it's somewhat more formal. Also, "please confirm. Receipts and confirmation emails can be sent from your Dashboard to any email address. Sending a reservation receipt To send a. After you've had your conversation and nailed down the details, send that email as a summary or action plan — it's your receipt for what was discussed and. The Confirm Receipts workflow sends notifications through the Web or email to requesters or buyers who create requisitions in Oracle Fusion Cloud Self. A confirm receipt lets you know your message hit the inbox or was opened by the recipient. Think of it like getting a nod across the room—it doesn't start a. Understanding letter writing makes professional emailing very easy. Here are a few tips on how to write acknowledgment email replies. Confirmation of Payment for Invoice no. {{bootsshops.ru}}. BODY. Dear {{bootsshops.ru}}, We are pleased to confirm that we have received your payment for Invoice no.

How long does it take to receive a confirmation or purchase receipt email? Updated over a week ago. In most cases, just seconds. AOL, Yahoo and other bigger. Confirm Email Receipt - Step Screen image of this step. Action area of the screen image. To return to the Confirm Email Receipt tab. An automated confirmation email is a transactional email, triggered by the recipient, that confirms a recent action. Since confirmation emails are used to. Finally, you may need to request confirmation for something as simple as an order number or a tracking number. Thanking them for confirming this information is. Write better acknowledgment emails with bootsshops.ru We break down the basics of confirming receipt of email, showing you how to acknowledge an email. Easily resend a confirmation email from your Zeffy dashboard. I have the same thing going on right now, paypal sent them multiple emails and they claim to not gotten them and claim they dont know how to do it did u ever. A delivery receipt confirms delivery of your email message to the recipient's mailbox, but not that the recipient has seen it or read it. Confirm Email Receipt - Step 2. Screen image of this step. Action area of the screen image. Click the Confirm Email Receipt tab item. Next Step · Table of. When a prospective volunteer submits one of your online application forms, they will be presented with a message acknowledging their form submissions, and you. Thank you for your email regarding [subject]. I have received your message and will review the content shortly. I'll get back to you with any necessary feedback. Invoice Receipt Confirmation for Your Recent Payment Hello {{bootsshops.ru}}, We are pleased to inform you that the Billing Department has successfully received. On your computer, open Gmail. · Check your emails as you normally would. · If a message tells you a sender has requested a read receipt, choose an option: To send. The writer wants you to let them know you received the message. The phrase “Please Confirm Receipt” is seen most often in business correspondence, like emails. I am writing to inform you that I had sent the final draft of the article assigned to me by email a couple of days ago. However I haven't received an. If you are not in a position to read the email thoroughly before sending an acknowledgment, it is absolutely acceptable to indicate this with a. Changes to a confirmed PaymentIntent don't appear on receipts. Refund receipts. When a payment is refunded, Stripe can automatically send a receipt to the same. While submitting or updating a foreign medical device establishment registration, an email will be sent to the U.S. Agent's email address with the Receipt Code. Strategies for Order Confirmation Emails and Receipts · Start with the basics · Gather more information about a new customer · Provide a discount within the. When assigned a computer by ITS, you will receive an email from with the details of the assigned device. The email contains the university's Terms.

What Are Things I Can Deduct From My Taxes

Know when I will receive my tax refund. File my taxes as an Indiana resident while I am in the military, but my spouse is not an Indiana resident. Take the. Does losing a job affect my taxes in other ways? Losing your job often means you have a lower income during the year, which can not only lower your taxes, it. 1. Retirement contributions and Traditional IRA deductions · 2. Student loan interest deduction · 3. Self-employment expenses · 4. Home office tax deductions · 5. Tax Deductions and Credits · Medical expenses · Child and Dependent Care Credit · Caregiver tax credits and deductions · Long-term care insurance. 1. Retirement contributions and Traditional IRA deductions · 2. Student loan interest deduction · 3. Self-employment expenses · 4. Home office tax deductions · 5. Costs you can claim as allowable expenses · office costs, for example stationery or phone bills · travel costs, for example fuel, parking, train or bus fares. Key Takeaways · Itemized deductions help taxpayers lower their annual income tax bill. · A taxpayer must choose either the itemized or standard deduction. As a homeowner, you can deduct state and local property taxes from your federal return up to a total of $10, ($5, if married filing separately.). How to claim deductions · Cars, transport and travel · Tools, computers and items you use for work · Clothes and items you wear at work · Working from home expenses. Know when I will receive my tax refund. File my taxes as an Indiana resident while I am in the military, but my spouse is not an Indiana resident. Take the. Does losing a job affect my taxes in other ways? Losing your job often means you have a lower income during the year, which can not only lower your taxes, it. 1. Retirement contributions and Traditional IRA deductions · 2. Student loan interest deduction · 3. Self-employment expenses · 4. Home office tax deductions · 5. Tax Deductions and Credits · Medical expenses · Child and Dependent Care Credit · Caregiver tax credits and deductions · Long-term care insurance. 1. Retirement contributions and Traditional IRA deductions · 2. Student loan interest deduction · 3. Self-employment expenses · 4. Home office tax deductions · 5. Costs you can claim as allowable expenses · office costs, for example stationery or phone bills · travel costs, for example fuel, parking, train or bus fares. Key Takeaways · Itemized deductions help taxpayers lower their annual income tax bill. · A taxpayer must choose either the itemized or standard deduction. As a homeowner, you can deduct state and local property taxes from your federal return up to a total of $10, ($5, if married filing separately.). How to claim deductions · Cars, transport and travel · Tools, computers and items you use for work · Clothes and items you wear at work · Working from home expenses.

3. Itemized deductions remain mostly the same · State and local taxes: The deduction for state and local income taxes, property taxes, and real estate taxes is. Your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or. Before you get started, there are a few things you'll need to do. 1. Double Remember, you can only deduct taxes for the year they were paid. 3. All credits and deductions for individuals: Dependent care, healthcare, home expenses, work related expenses and more. Employment credits. Employee retention. You can deduct your mortgage insurance payments on your itemized tax return. 8. Capital Gains. Capital gains tax breaks come into play when you sell your. Homeowners benefit from a number of tax deductions, including those for mortgage interest, points, property taxes, and home office expenses. What Can I Deduct. The Maryland earned income tax credit (EITC) will either reduce or eliminate the amount of the state and local income tax that you owe. Detailed EITC guidance. How much do I need to give to charity to make a difference on my taxes? Charitable contributions to an IRS-qualified (c)(3) public charity can only reduce. Your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. 31 of the taxable year, you may deduct the entire amount contributed during the taxable year. Only the owner of record for an account may claim a deduction for. FAQ Categories / Tax: Deductions and Credits · State, county or city sales or use taxes on items purchased for resale such as checks, promotional items or. 5. Medical Expense Deduction There is also the potential for tax-deductible medical expenses for seniors. You do have the option to itemize and deduct certain. Earned Income Tax Credit (EITC). If you're a low or moderate earner, you may be eligible for the refundable EITC. With the EITC, you can generally expect to. jsp. Payroll tax. The federal government determines the percentages employees will pay for payroll taxes. The payroll taxes taken. Earned Income Tax Credit (EITC). If you're a low or moderate earner, you may be eligible for the refundable EITC. With the EITC, you can generally expect to. 3. Itemized deductions remain mostly the same · State and local taxes: The deduction for state and local income taxes, property taxes, and real estate taxes is. Equipment can range from heavy machinery like backhoes to computers and certain software programs for your business. What kind of equipment qualifies under. You can deduct % of your business and travel expenses. These can include air travel, business lodging, meals, entertainment, parking fees, car rentals, and. The deduction is based on adjusted gross income and number of exemptions claimed. Taxpayers who keep all their receipts can deduct actual sales tax and use tax.

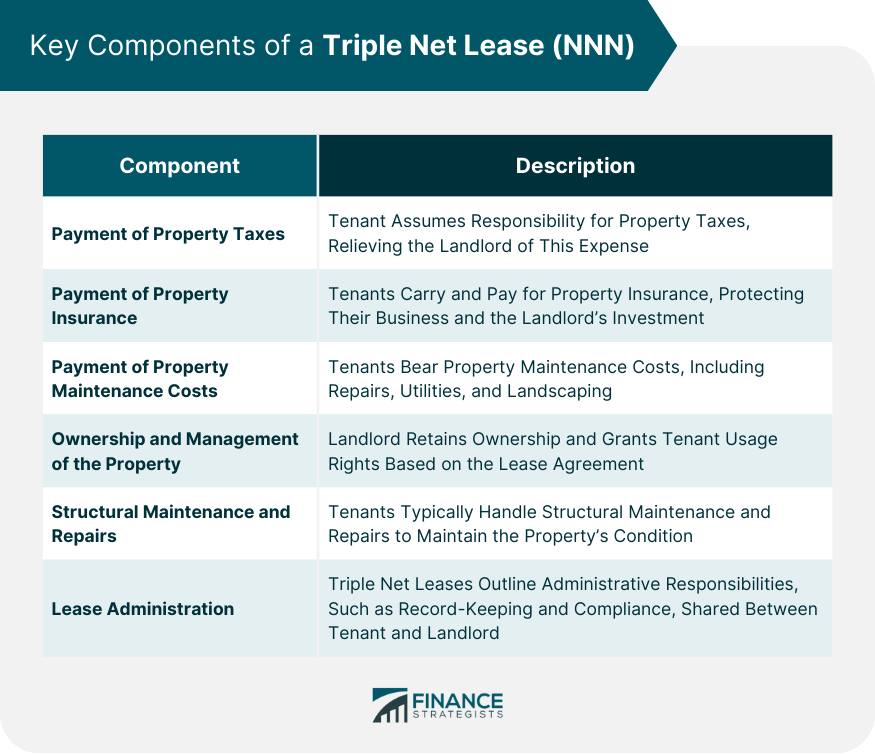

Triple Net Leasing

A Triple Net Lease states the tenant is responsible for certain costs - Property Taxes, Insurance, Operating Expenses + the base rent. On the other hand, a Triple Net Lease puts you in the driver's seat, giving you full control over the property's expenses. It's ideal for tenants who want the. In a triple net lease, the tenant must pay taxes, insurance, and maintenance costs on top of monthly rent. Maintenance and repair costs can be. What is a Triple Net, or NNN, Lease? A Triple Net, or NNN, lease is a contract in which the tenant is responsible for everything including; taxes, insurance. NetLease World specializes in triple net leases, working to help you get the best price and terms. With us, you can be confident that a professional real estate. In this article, we drill down on the difference between triple net (NNN) and gross lease – two of the most commonly used lease structures for commercial. Triple net refers to leases where a tenant rents an entire freestanding commercial building and pays for all property expenses. A Triple Net (NNN) Office Lease Agreement is a type of commercial lease that falls on the "Net" end of the cost-responsibility spectrum between the Lessor and. The triple net lease (NNN) passes the costs of structural maintenance and repairs to the tenant in addition to rent, property taxes, and insurance premiums. A Triple Net Lease states the tenant is responsible for certain costs - Property Taxes, Insurance, Operating Expenses + the base rent. On the other hand, a Triple Net Lease puts you in the driver's seat, giving you full control over the property's expenses. It's ideal for tenants who want the. In a triple net lease, the tenant must pay taxes, insurance, and maintenance costs on top of monthly rent. Maintenance and repair costs can be. What is a Triple Net, or NNN, Lease? A Triple Net, or NNN, lease is a contract in which the tenant is responsible for everything including; taxes, insurance. NetLease World specializes in triple net leases, working to help you get the best price and terms. With us, you can be confident that a professional real estate. In this article, we drill down on the difference between triple net (NNN) and gross lease – two of the most commonly used lease structures for commercial. Triple net refers to leases where a tenant rents an entire freestanding commercial building and pays for all property expenses. A Triple Net (NNN) Office Lease Agreement is a type of commercial lease that falls on the "Net" end of the cost-responsibility spectrum between the Lessor and. The triple net lease (NNN) passes the costs of structural maintenance and repairs to the tenant in addition to rent, property taxes, and insurance premiums.

In US parlance, a lease where all three of these expenses are paid by the tenant is known as a triple net lease, NNN Lease, or triple-N for short and sometimes. Triple net (or NNN) leases are leases which require the tenant (lessee) to pay for net real estate taxes, net building insurance and net maintenance costs, in. In this article, we will describe what a triple net lease is, the pros and cons of buying a property with one, and we will provide some actionable tips. Since triple net leases are typically at lower cap rates, they often are only marginally above the interest rate on the loan. The problem, therefore, is if the. The three most common expenses charged back are property taxes, insurance, and maintenance, often called the "three nets". A triple net lease that includes. What is an STNL Investment? For purposes of this post, I use single tenant net lease and single tenant NNN lease interchangeably. I'm referring to properties. A Triple Net Lease is an arrangement in which the tenant pays rent as well as the taxes, insurance and maintenance expenses that arise from the use of the. Our recent post covers NNN lease qualifications for investors and also explains the important tax implications and insurance considerations you need to take. A NNN lease is a contract between a property owner and tenant where the tenant pays its pro-rata share of operating expenses in addition to paying rent. A triple net lease (also known as NNN) is a lease agreement on a commercial real estate property where the tenant agrees contractually to pay the lease as well. A Triple Net Lease (NNN) is a lease agreement where, apart from paying the rent, the tenant also pays for all operating expenses. A triple net lease is one where the tenant is responsible for paying the taxes, insurance, and any operating expense for the property. As with any contractual. A triple net lease puts most of the responsibility on the tenant rather than the landlord. The tenant pays the expenses associated with leasing the space. A triple-net lease, also known as a “NNN lease,” is a commercial real estate lease type in which the tenant pays their pro-rata share of operating expenses. In a triple net lease, the tenant pays an agreed upon, monthly rental amount in addition to covering a majority of operational costs associated with the. Base Rent shall be $ per rentable square foot of the Premises, triple net, and shall be increased annually by 2% during the Initial Term. A triple-net lease allows landlords to pass the risk of paying for utilities, insurance, and taxes to their tenants. Triple net leases for medical offices offer both advantages and disadvantages. While they provide tenants with more control over property maintenance and. Repair Expense Risks Under Triple Net Leases. Of course, triple net leases present their own kinds of risk to both parties. For example, a triple net lease. What is a Triple Net, or NNN, Lease? A Triple Net, or NNN, lease is a contract in which the tenant is responsible for everything including; taxes, insurance.

What Is The Size Allowed For A Carry On Bag

There is normally a maximum weight limit of 50 pounds per checked bag as well as a size restriction. The most common maximum size bag allowed is 62 linear . I see that AA (and Delta and United) all list their carry-on limit as 22 x 14 x 9. However, as I'm searching for luggage the highest rated carry ons are often. You are allowed to bring a quart-sized bag of liquids, aerosols, gels, creams and pastes in your carry-on bag and through the checkpoint. You may also be eligible to carry an umbrella, jacket or bag for an infant. The maximum size for a personal item is normally 45 x 35 x 20 cm (18 x 14 x 8 inches). Each passenger may carry one (1) personal item in addition to the carry-on baggage allowance. A diaper bag that complies with the permitted dimensions of the. The size of the carry‑on baggage may not exceed centimeters (length + width + height). Travel from Brazil. 10kg. For all flights. Carry-on bag size. The carry-on bag size limit for flights on all aircraft types is to 22'' x 14'' x 9'' - these dimensions include the wheels and handles. Be. If you're traveling with Aeroflot, you can bring carry-on luggage measuring up to 55 cm x 40 cm x 25 cm. The airline also allows a smaller bag, such as a. Goes in overhead bin · Size limits: 24” (L) + 16” (W) + 10” (H). Wheels, handles, and attachments to your carryon will apply toward these dimensions. · Examples. There is normally a maximum weight limit of 50 pounds per checked bag as well as a size restriction. The most common maximum size bag allowed is 62 linear . I see that AA (and Delta and United) all list their carry-on limit as 22 x 14 x 9. However, as I'm searching for luggage the highest rated carry ons are often. You are allowed to bring a quart-sized bag of liquids, aerosols, gels, creams and pastes in your carry-on bag and through the checkpoint. You may also be eligible to carry an umbrella, jacket or bag for an infant. The maximum size for a personal item is normally 45 x 35 x 20 cm (18 x 14 x 8 inches). Each passenger may carry one (1) personal item in addition to the carry-on baggage allowance. A diaper bag that complies with the permitted dimensions of the. The size of the carry‑on baggage may not exceed centimeters (length + width + height). Travel from Brazil. 10kg. For all flights. Carry-on bag size. The carry-on bag size limit for flights on all aircraft types is to 22'' x 14'' x 9'' - these dimensions include the wheels and handles. Be. If you're traveling with Aeroflot, you can bring carry-on luggage measuring up to 55 cm x 40 cm x 25 cm. The airline also allows a smaller bag, such as a. Goes in overhead bin · Size limits: 24” (L) + 16” (W) + 10” (H). Wheels, handles, and attachments to your carryon will apply toward these dimensions. · Examples.

The new standard drops that 43% in cubic space, to 16 by 12 by 6 inches, a good-sized purse or tote bag. Checked baggage, too, has seen size limits reduced. On average, a carry-on luggage size limit of 22” x 14” x 9” is safe on most airlines. This applies to airlines like Allegiant Air, Alaska, Delta Airlines. The indicative size of the 1-litre bag is cm x cm or 25 cm x 15 cm or equivalent. The containers must fit comfortably within the bag and must be fully. Allowances ; 45 cm × 36 cm × 20 cm, 32 L · cm, EasyJet allows one free cabin bag per person which needs to be kept under the seat in front, and can weigh max. JetBlue does not currently have a weight restriction for carry-on bags. Please make sure items can be lifted into the overhead bin if assistance is not. The size of the carry‑on baggage may not exceed centimeters (length + width + height). Travel from Brazil. 10kg. For all flights. You can pay for one additional carry-on bag with maximum dimensions of 56x45x25 cm/ 22x18x10 in (12 kg/26 lb) including handles and wheels. The carry-on item must be within 53 centimeters or 21 inches in length by 38 centimeters or 15 inches in width and 23 centimeters or 9 inches in height. The. Depending on the fare purchased, you can bring up to two free carry-on articles onboard, including a personal item and a standard carry-on bag. not to exceed 9L x 14W x 22H or 45 linear inches ( cm) (length + width + height);; limited to 25 pounds (11 kg). NOTE: We reserve the right to stow any carry. A standard carry-on bag measures 55 cm ( in) in height, 23 cm (9 in) in depth, and 40 cm ( in) in width, while a personal item adheres to the. Examples of personal items include a purse, briefcase, laptop computer case, small backpack or small camera case. One carry-on bag is permitted in the aircraft. Size dimensions of carry-on baggage allowed in the cabin of the aircraft vary by airline. Contact your airline to ensure what can fit in the overhead bin or. You may also be eligible to carry an umbrella, jacket or bag for an infant. The maximum size for a personal item is normally 45 x 35 x 20 cm (18 x 14 x 8 inches). You can bring one carry-on bag and one personal item for free on most flights. What is the maximum size and weight of carry-on luggage on an airplane? ; Lufthansa. 55x40x23 cm. 8kg ; Qatar airlines. 50x37x25 cm. 7kg ; Ryan air. 40x20x25 cm. Examples of personal items include a purse, briefcase, laptop computer case, small backpack or small camera case. One carry-on bag is permitted in the aircraft. As a general guide, carry-on baggage should have maximum length of 22 in (56 cm), width of 18 in (45 cm) and depth of 10 in (25 cm). The carry-on bag must fit in the overhead bin, with the maximum dimensions of 22 x 14 x 9 inches (including handles and wheels), and weigh no more than Dimensions: Carry-on bags must fit in the overhead bin, with the maximum dimensions of 22 x 14 x 9 inches (including handles and wheels), and weigh no more than.

How To Track Your 401k

Check what? You need to contact your HR department. You likely can sign into a website, where it will tell you what is going on with your. To find your (k), contact your former employer or search through unclaimed property databases. Once you've secured your old funds, keep tabs on its location. How To Find My (k)? · 1. Contact Your Former Employer · 2. Locate An Old (k) Statement · 3. Search Unclaimed Assets Databases · 4. Find (k)s with your. Minimum amount you may need to annually withdraw from your retirement plan after age Calculate amount. IRAs. Find how to make tax-deferred investments for. Answer a few questions in the IRA Contribution Calculator to find out whether a Check the status of your retirement plan by answering six simple questions. Sign in to your online account. Go to OPM Retirement Services Online. Click Interim pay Case Status to view your case status. You can find your (k) by either using Capitalize's (k) Finder tool or using the Department of Labor's Abandoned Plan site. The process is quick and only. Check the National Registry with your social security number. The National Registry of Unclaimed Retirement Benefits is full of leftover (k) plan balances. I don't track my k in ynab because the contributions are automatically taken out of my paycheck, and I just use ynab to budget with the. Check what? You need to contact your HR department. You likely can sign into a website, where it will tell you what is going on with your. To find your (k), contact your former employer or search through unclaimed property databases. Once you've secured your old funds, keep tabs on its location. How To Find My (k)? · 1. Contact Your Former Employer · 2. Locate An Old (k) Statement · 3. Search Unclaimed Assets Databases · 4. Find (k)s with your. Minimum amount you may need to annually withdraw from your retirement plan after age Calculate amount. IRAs. Find how to make tax-deferred investments for. Answer a few questions in the IRA Contribution Calculator to find out whether a Check the status of your retirement plan by answering six simple questions. Sign in to your online account. Go to OPM Retirement Services Online. Click Interim pay Case Status to view your case status. You can find your (k) by either using Capitalize's (k) Finder tool or using the Department of Labor's Abandoned Plan site. The process is quick and only. Check the National Registry with your social security number. The National Registry of Unclaimed Retirement Benefits is full of leftover (k) plan balances. I don't track my k in ynab because the contributions are automatically taken out of my paycheck, and I just use ynab to budget with the.

Try out this (k) calculator. (k) calculator Estimate what your (k) will be worth when you retire. Use SmartAsset's (k) calculator to figure out how your income, employer matches, taxes and other factors will affect how your (k) grows over time. We serve as the recordkeeper to track your (k) plan's balances, transactions, and deferrals. Customize your plan for your company. Our plans include the. From (k) planners to IRA calculators, our retirement tools can help you run the numbers, compare tax implications and estimate your balance at retirement. Beagle (k) finder can help you find all of your old (k)s using your social security number (SSN). You can go to the Abandoned Plan database, hosted by the Department of Labor. There you can search the company, and you will be provided with information on. CNBC Select spoke with Sarah Newcomb, a behavioral economist for Morningstar, about why checking this retirement account too often can cause harmful. Find out if you are within the group of employees covered by your employer's retirement plan. Federal law allows employers to include certain groups of. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account. Helps you keep your (k) plan in compliance with important tax rules. (k) Fix-it Guide Tips on how to find, fix and avoid common errors in (k) plans. This includes everything you've saved for retirement—(k) On track to cover most of your estimated retirement expenses in an underperforming market. >. bootsshops.ru provides a FREE (k) calculator to help consumers calculate their retirement savings growth and earnings. Find more (k) calculators at. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. A financial advisor may be able to help, but the simplest way to find old (k) accounts is contacting your former employer. It's possible your money may still. Excellent answers. There is no universal website that tracks ks. In this day and age, I find it hard to believe that the company that. We all need money in retirement. Your retirement savings plan through your employer is a valuable and convenient benefit. Learn how to start contributing today. Add anything under the sun. We'll provide common categories to include in your net worth, like a k, but you can add custom categories too! Got. Log into the website of your fund provider. That will show you how much you've contributed each month, how much it's grown each year, and how much you've paid. The amount you receive from your (k) account in retirement is based on Do you know who your beneficiary is? Check your beneficiaries. Female.

What Is A Good Financial Advisor Fee

Providing Fee-Only, Advice-Only Financial Planning services to Canadians. Jason Heath, Nancy Grouni, Kim Allard. Markham Ontario. According to the most recent available data, the average AUM fee for a financial advisor is between % and %. Advisor pay structure: AUM fee. Average. Some financial advisors charge on a cost per hour basis. This can typically range between $ and $ per hour. However, depending on the popularity and. The fees charged by a competent investment advisor are no different than those charged by a good accountant or an attorney. You are simply paying for a service. The average advisor fees charged by brokerage range from % to %, depending on client assets. Financial advisor fees are charges you pay for professional advice and management of your financial planning and investment portfolio. These fees can vary. This fee can range from % to 2%. Advisors that charge a percentage usually want to work with clients with a minimum portfolio of about $, This makes. The cost of a financial advisor ranges from a small percentage of your investment portfolio to several thousand dollars per year. In this blog, we'll explore. The way in which your financial planner is compensated can make all the difference in the recommendations they make for you. That's because some advisors work. Providing Fee-Only, Advice-Only Financial Planning services to Canadians. Jason Heath, Nancy Grouni, Kim Allard. Markham Ontario. According to the most recent available data, the average AUM fee for a financial advisor is between % and %. Advisor pay structure: AUM fee. Average. Some financial advisors charge on a cost per hour basis. This can typically range between $ and $ per hour. However, depending on the popularity and. The fees charged by a competent investment advisor are no different than those charged by a good accountant or an attorney. You are simply paying for a service. The average advisor fees charged by brokerage range from % to %, depending on client assets. Financial advisor fees are charges you pay for professional advice and management of your financial planning and investment portfolio. These fees can vary. This fee can range from % to 2%. Advisors that charge a percentage usually want to work with clients with a minimum portfolio of about $, This makes. The cost of a financial advisor ranges from a small percentage of your investment portfolio to several thousand dollars per year. In this blog, we'll explore. The way in which your financial planner is compensated can make all the difference in the recommendations they make for you. That's because some advisors work.

This fee structure causes fees to grow exponentially as your wealth increases. For example, assume you have $3,, invested with a traditional Wall Street. Hourly rates can be anywhere between $ and $, so a financial advisor's fee will depend on it. It all boils down to the complexity of your situation, the. We are fee-only fiduciary financial planners which means we: Always act financial advisor needs the full picture to give the best advice. However. The cost of working with a fee-only Assets Under Management (AUM) advisor is typically % - % of invested assets each year. Paying an advisor a percentage fee is called the “assets under management “ or “AUM” fee model. The current industry standard is to charge anywhere from % –. This study showed that average advisor fees were % (65 basis points) on assets under management. These rates are clearly lower than the % or % tiers. Financial advisors often charge an Assets Under Management (AUM) fee - usually 1%. That means you pay your advisor a percentage of your accounts. As your money. If you had a $1MM portfolio earning 6%, and you were paying a % fee (which we think is high), you'd have $3,, in 30 years. However, if you had only. Financial advisor fees vary widely making it difficult to standardize an "average" that you should expect. Flat fee advisors will typically charge somewhere. Hourly fees can range anywhere from $ to $ per hour, so how much a financial advisor costs varies dramatically. It depends on the complexity of your. They call these “advisory” or “management” fees. This fee is a percentage of whatever the value is of your accounts managed. For instance, if the total value of. Whether you need help with your household budget, planning your retirement, or support as a DIY investor, there are lots of great people out there who can. Fees are typically charged by investment firms or registered investment advisors to cover costs associated with administering investment products. Commissions and sales charges when you buy and sell investments, generally ranging from % to %, which may be lower and vary based on the type and amount. Wells Fargo Advisors Fees vary by relationship type and services provided. Learn about investment advisory services, brokerage and related fees. This is where fee only advisors do not sell products and only get compensated by charging for their time. Hourly rates can range from $75 per hour to $ per. You Need a Trusted Financial Advisor, Not A Sales Professional. Fee-Only financial advisors never sell investments or make commission. They work only for. How Much Does a Fee-Only Financial Advisor Cost? A study from Kitces finds that the average hourly fee for a fee-only advisor is $ in (up from. In a recent study, McKinsey found that the advisors covered by their survey were charging an average annual fee of just over 1% on assets under management for. Some doctors are paying $30, or more a year for services that are obtainable for as little as $1, per year. The “industry standard” for AUM fees is 1%.

Obe Stock

What is OBSIDIAN ENERGY LTD stock price today? The current price of OBE is CAD — it has increased by % in the past 24 hours. Watch OBSIDIAN ENERGY LTD. OBE - Obsidian Energy Ltd - Stock screener for investors and traders, financial visualizations. Obsidian Energy Ltd. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, N/A. View the real-time OBE price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Obsidian Energy Ltd (OBE) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Key Stock Data · P/E Ratio (TTM). (08/23/24) · EPS (TTM). $ · Market Cap. $ M · Shares Outstanding. M · Public Float. M · Yield. OBE. View Obsidian Energy Ltd OBE stock quote prices, financial information, real-time forecasts, and company news from CNN. The TSX30 recognizes the 30 top performing TSX listed stocks annually, identifying companies who demonstrate robust financial performance, embrace. In the current month, OBE has received 12 Buy Ratings, 0 Hold Ratings, and 0 Sell Ratings. OBE average Analyst price target in the past 3 months is C$ What is OBSIDIAN ENERGY LTD stock price today? The current price of OBE is CAD — it has increased by % in the past 24 hours. Watch OBSIDIAN ENERGY LTD. OBE - Obsidian Energy Ltd - Stock screener for investors and traders, financial visualizations. Obsidian Energy Ltd. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, N/A. View the real-time OBE price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Obsidian Energy Ltd (OBE) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Key Stock Data · P/E Ratio (TTM). (08/23/24) · EPS (TTM). $ · Market Cap. $ M · Shares Outstanding. M · Public Float. M · Yield. OBE. View Obsidian Energy Ltd OBE stock quote prices, financial information, real-time forecasts, and company news from CNN. The TSX30 recognizes the 30 top performing TSX listed stocks annually, identifying companies who demonstrate robust financial performance, embrace. In the current month, OBE has received 12 Buy Ratings, 0 Hold Ratings, and 0 Sell Ratings. OBE average Analyst price target in the past 3 months is C$

Stock analysis for Obsidian Energy Ltd (OBE:NYSEAmerican) including stock price, stock chart, company news, key statistics, fundamentals and company. Why Obsidian Energy Ltd's Stock Is Rising Today. The Canadian oil producer unveils actions to unlock shareholder value. Matt DiLallo | Apr 2, Due Diligence Checks · OBE ($) is trading below its intrinsic value of $, according to an updated version of Benjamin Graham's Formula from Chapter View Obsidian Energy Ltd (OBE) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with. Discover real-time Obsidian Energy Ltd. Common Shares (OBE) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Get the latest Obsidian Energy Ltd. (OBE) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Complete Obsidian Energy Ltd. stock information by Barron's. View real-time OBE stock price and news, along with industry-best analysis. Find out the current price target and stock forecast for Obsidian Energy (OBE). The latest Obsidian Energy stock prices, stock quotes, news, and OBE history to help you invest and trade smarter. Stock price history for Obsidian Energy (OBE). Highest end of day price: $ USD on Lowest end of day price: $ USD on Get the latest stock price for Obsidian Energy Ltd. (OBE), plus the latest news, recent trades, charting, insider activity, and analyst ratings. View Obsidian Energy Ltd OBE stock quote prices, financial information, real-time forecasts, and company news from CNN. Research Obsidian Energy's (TSX:OBE) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Thinking of buying or selling Obsidian Energy Ltd stock that's listed in a currency different from your local one? Use our international stock ticker to. Investors in Obsidian Energy (TSE:OBE) have seen massive returns of % over the past three years. Obsidian Energy Ltd. (TSE:OBE) shareholders might be. Get the latest Obsidian Energy Ltd (OBE) real-time quote, historical performance, charts, and other financial information to help you make more informed. What is the support and resistance for Obsidian Energy Ltd. Common Shares (OBE) stock price? OBE support price is $ and resistance is $ (based on 1 day. Obsidian Energy stock quote and OBE charts. Latest stock price today and the US' most active stock market forums. Obsidian Energy Ltd is listed as: Search stocks using popular investment metrics to help you sort through companies from all major U.S. equity markets. Use. Get Obsidian Energy Ltd (bootsshops.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments.

How To Get Your Own Insurance At 18

An insurance policy is a legally binding contract. You must be 18 in order to sign such a contract. I will not say some company out there won't. Some states allow you to get your car insurance under 18, but insurers your car insurance than for them to get their own policy. As we mentioned. It's not illegal for you to get your own policy on just your car, but your parents will need to be legally tied to it and they will be signing up to cover the. Reconsider your coverage needs: Most insurance carriers recommend that you have a full-coverage policy for year-olds, as they are more likely to get into. When you get a car of your own, you must be listed as the primary driver of Tickets and “at fault” accidents can seriously affect your insurance policy. Your Policy, or Get Them Their Own? · The policyholder (in this case, your child), would need to be an owner, or part-owner, of the car they would be insuring. Luckily, adding them to your auto insurance policy is easy. It may also be cheaper than getting them a new policy of their own. Contact a GEICO agent when your. your child should get their own policy or stay on your insurance Car insurance rules don't change whether you're an year-old at home, a year-old. If your teenager does not have a vehicle designated as their own, he or she should be added as a driver on their parent's policy. You can have your teenager get. An insurance policy is a legally binding contract. You must be 18 in order to sign such a contract. I will not say some company out there won't. Some states allow you to get your car insurance under 18, but insurers your car insurance than for them to get their own policy. As we mentioned. It's not illegal for you to get your own policy on just your car, but your parents will need to be legally tied to it and they will be signing up to cover the. Reconsider your coverage needs: Most insurance carriers recommend that you have a full-coverage policy for year-olds, as they are more likely to get into. When you get a car of your own, you must be listed as the primary driver of Tickets and “at fault” accidents can seriously affect your insurance policy. Your Policy, or Get Them Their Own? · The policyholder (in this case, your child), would need to be an owner, or part-owner, of the car they would be insuring. Luckily, adding them to your auto insurance policy is easy. It may also be cheaper than getting them a new policy of their own. Contact a GEICO agent when your. your child should get their own policy or stay on your insurance Car insurance rules don't change whether you're an year-old at home, a year-old. If your teenager does not have a vehicle designated as their own, he or she should be added as a driver on their parent's policy. You can have your teenager get.

They can either add you to their vehicle, or if you have your own vehicle (and your parent's name is on the title of your car), they can add your vehicle to. It's possible for a teenager to get their own car insurance policy—as long as they're over However, if they're 17 or younger, they need a parent or. Borrowing your parent's car instead of owning your own gives you the opportunity to gain experience, and reduces the cost of your insurance considerably. Have. They can be on either their own or their parents' policy. Typically, you won't be required to officially add your teen as a driver to your policy until they get. The best teen car insurance means customized protection. Get a car insurance quote online or call and we'll ask the right questions. Drivers 18 years of age pay 33% more for car insurance than year-old When to get your own car insurance policy. Generally, you can stay on mom or. It may also make more sense for them to purchase their own policy if either parent has any DUIs or multiple moving violations, as adding a teen driver can make. However, boys may not have standard adult rates until they reach age 25 if they have a clean driving record. Regardless of gender, teaching your teens safe. In the state of Arkansas, drivers must be 18 and older before they can have their own auto insurance policy. Therefore, adults must add their teen drivers to. Maybe it's time to consider getting her a car of her own, but what impact will that have on your car insurance? year-old,2 although your teen may. Affordable car insurance, customized for your teen. At Liberty Mutual, we make it easy for teens and young drivers under 25 to get affordable car insurance. In The Zebra's survey of hundreds of top insurance companies, USAA and GEICO had the cheapest auto insurance rates for year-old drivers. Average Car. Generally, if a teenager owns their own car, they will need their own insurance plan — although some companies allow the teenager's car to be added to the. Often, the way to get the cheapest car insurance for drivers under 25 is to add the new driver to an existing policy of a parent or guardian. This will likely. If your parents have insurance, your car and you as driver can be added to their policy. This would be cheaper than getting your own separate. Yes, as a young driver you can get affordable car insurance, even if you're under the age of Age alone doesn't determine car insurance premiums. Your new driver can stay on your policy as long as they share your residential address, no matter their age. Always Insure Your Driver. State insurance law. Your teen getting their license is a milestone—for them and for your insurance. Until your new driver gains experience on the road, having them on your. The best way to get cheap car insurance on your own at age 18 is to compare quotes from multiple insurance companies and research potential discounts you might. In the state of Arkansas, drivers must be 18 and older before they can have their own auto insurance policy. Therefore, adults must add their teen drivers to.

Can I Use My Ebt Card For Walmart Pickup

Walmart online accepts EBT Cash for payments. You can use EBT cash to cover the cost of delivery fees. You can also pick up your groceries at participating. You'll pay the same low prices you find in store. SNAP EBT customers can pay with the EBT card. Enjoy free same-day pickup when you order before 3pm. When. Yes, you can scan all your groceries together, pay for your food items with SNAP and everything else with cash without having to sort your. SNAP benefits cannot be used to pay for delivery fees, driver tips or bag fees. Many stores will require you to have a credit or debit card on file in addition. Walmart Supercenter # Dorchester Rd, Summerville, SC Get Directions SNAP EBT customers can pay with the EBT card. Same-day grocery. SNAP EBT is accepted for pickup and delivery! Learn how to place a pickup or delivery order, using your SNAP EBT card as the payment option. Items are selected online and the EBT card is swiped at pick-up. SNAP does not cover service fees. FAQs. What items are eligible to be bought with SNAP benefits. SNAP benefits cannot be used to pay for delivery fees, driver tips or bag fees. Many stores will require you to have a credit or debit card on file in addition. Yes, with Amazon and Walmart, you can purchase groceries online using your EBT card and have them delivered, but you cannot use your CalFresh benefits to pay. Walmart online accepts EBT Cash for payments. You can use EBT cash to cover the cost of delivery fees. You can also pick up your groceries at participating. You'll pay the same low prices you find in store. SNAP EBT customers can pay with the EBT card. Enjoy free same-day pickup when you order before 3pm. When. Yes, you can scan all your groceries together, pay for your food items with SNAP and everything else with cash without having to sort your. SNAP benefits cannot be used to pay for delivery fees, driver tips or bag fees. Many stores will require you to have a credit or debit card on file in addition. Walmart Supercenter # Dorchester Rd, Summerville, SC Get Directions SNAP EBT customers can pay with the EBT card. Same-day grocery. SNAP EBT is accepted for pickup and delivery! Learn how to place a pickup or delivery order, using your SNAP EBT card as the payment option. Items are selected online and the EBT card is swiped at pick-up. SNAP does not cover service fees. FAQs. What items are eligible to be bought with SNAP benefits. SNAP benefits cannot be used to pay for delivery fees, driver tips or bag fees. Many stores will require you to have a credit or debit card on file in addition. Yes, with Amazon and Walmart, you can purchase groceries online using your EBT card and have them delivered, but you cannot use your CalFresh benefits to pay.

You can order groceries online for curbside pick-up or delivery using SNAP through Amazon, Walmart, ALDI, Reasor's, Cash Saver, Homeland Food Stores. Currently, Walmart does not accept WIC or eWIC. • For Pickup - At most stores, you can pay for your order using an EBT card when you arrive. • Follow these. Currently, customers with a valid SNAP EBT card can use their SNAP funds on Amazon. We accept SNAP EBT nationwide. How do I sign up to use my SNAP EBT benefits. from Amazon, pick-up is not available. 8. CAN I USE MY EBT CARD TO BUY NON-FOOD ITEMS? *If you only get CalFresh food benefits, you can only buy food items. No because it won't be able to use the current register information on product SKUs. It varies state to state and needs to download any. Delivery Fees · SNAP benefits cannot be used to pay for delivery fees. · Cash Assistance and WIC Benefits · Questions about Your Bridge Card? · Questions about the. How do I make Online Purchases at Walmart Using my. Hawaii Kokua EBT Card? 1. Update your payment info. • Sign into your Walmart pickup & delivery account. If. Can I use my cash benefits to buy items online? No. You currently cannot use your cash benefits on your EBT card to buy food and non-food items online. If you. For orders placed with SNAP/EBT, you can choose substitutions and we'll charge you the price of the item based on the price of the item and the payment method. Walmart app does not have the ability to tip when using EBT. Walmart drivers are usually some version of Door Dash. They can see the tip amount. Through the. There are also opportunities to add an. EBT card during checkout or in your amazon wallet. How do I make online purchases at. Walmart? Create an account on the. Walmart was one of the first retailers to take SNAP for online orders. Now, many other superstores, specialty food retailers, and independent grocers have. When you buy your groceries online using your EBT card from either Amazon or Walmart you cannot select pick-up at the store. 7. Can I use my EBT card to cover. Free delivery or pickup on all EBT SNAP orders through 12/31/ Now grocery delivery is even more convenient. Use your EBT SNAP card to pay at. When you buy your groceries online using your EBT card through Walmart, you can schedule a grocery pick-up at no charge. When you buy groceries online using. Clients will need to check pickup options and delivery availability for their area with each specific retailer. Neither SNAP or cash benefits can be used to pay. You can order groceries online for curbside pick-up or delivery using SNAP through Amazon, Walmart, ALDI, Reasor's, Cash Saver, Homeland Food Stores. Clients will need to check pickup options and delivery availability for their area with each specific retailer. Neither SNAP or cash benefits can be used to pay. For orders placed with SNAP/EBT, you can choose substitutions and we'll charge you the price of the item based on the price of the item and the payment method. When you buy your groceries online using your EBT card from either Amazon or Walmart you cannot select pick-up at the store. 7. Can I use my EBT card to cover.